An Unbiased View of Guided Wealth Management

Table of ContentsNot known Incorrect Statements About Guided Wealth Management Fascination About Guided Wealth ManagementThe Single Strategy To Use For Guided Wealth ManagementThe Main Principles Of Guided Wealth Management Guided Wealth Management Can Be Fun For Everyone

For investments, make settlements payable to the item service provider (not your advisor). Offering an economic advisor complete accessibility to your account raises danger.If you're paying a continuous recommendations charge, your advisor should assess your monetary circumstance and consult with you a minimum of when a year. At this meeting, see to it you go over: any kind of modifications to your objectives, circumstance or funds (consisting of adjustments to your earnings, expenses or properties) whether the level of danger you fit with has actually changed whether your existing personal insurance cover is right how you're tracking against your objectives whether any kind of adjustments to laws or financial items could influence you whether you've received everything they promised in your arrangement with them whether you need any kind of changes to your strategy Each year an advisor have to seek your written approval to bill you recurring suggestions charges.

This may take place throughout the meeting or online. When you go into or restore the recurring fee plan with your consultant, they need to define exactly how to end your relationship with them. If you're moving to a brand-new consultant, you'll require to set up to move your monetary records to them. If you require aid, ask your consultant to discuss the procedure.

Guided Wealth Management - An Overview

As an entrepreneur or little service owner, you have a great deal taking place. There are numerous obligations and expenditures in running an organization and you definitely do not require an additional unneeded costs to pay. You require to carefully take into consideration the roi of any type of services you reach make sure they are worthwhile to you and your company.

If you're one of them, you may be taking a big danger for the future of your company and yourself. You may want to continue reading for a checklist of reasons employing a financial expert is helpful to you and your organization. Running a service is complete of challenges.

Money mismanagement, cash money circulation problems, overdue repayments, tax concerns and various other monetary troubles can be important adequate to close a business down. There are many methods that a qualified monetary expert can be your partner in aiding your organization grow.

They can deal with you in evaluating your economic circumstance often to stop serious mistakes and to swiftly fix any negative money choices. A lot of local business proprietors use numerous hats. It's understandable that you intend to save cash by doing some work yourself, yet handling financial resources takes understanding and training.

Some Known Incorrect Statements About Guided Wealth Management

You require it to know where you're going, just how you're obtaining there, and what to do if there are bumps in the road. An excellent economic advisor can place with each other a comprehensive strategy to aid you run your business much more effectively and prepare for abnormalities that emerge.

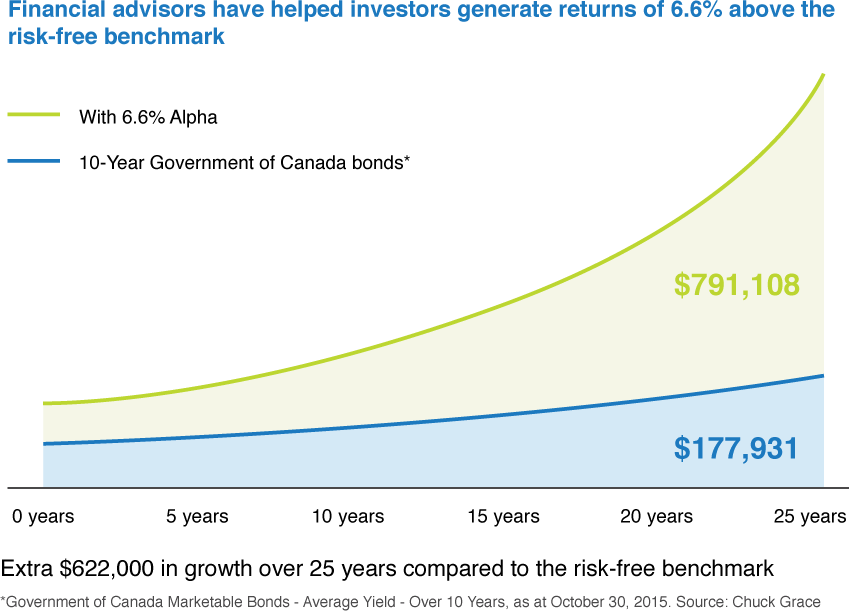

A trustworthy and educated economic consultant can assist you on the investments that are right for your business. Cash Financial savings Although you'll be paying a monetary advisor, the long-term financial savings will certainly validate the expense.

Decreased Stress As an organization owner, you have whole lots of things to stress about. A great economic consultant can bring you tranquility of mind understanding that your funds are getting the focus they need and your money is being spent wisely.

How Guided Wealth Management can Save You Time, Stress, and Money.

Stability and Growth A qualified monetary expert can my explanation offer you clarity and aid you concentrate on taking your organization in the ideal direction. They have the devices and resources to utilize strategies that will guarantee your service grows and thrives. They can assist you evaluate your goals and determine the very best course to reach them.

The 8-Second Trick For Guided Wealth Management

At Nolan Bookkeeping Facility, we supply competence in all aspects of monetary preparation for local business. As a small company ourselves, we understand the difficulties you deal with on an everyday basis. Give us a phone call today to review how we can aid your business flourish and prosper.

Independent possession of the practice Independent control of the AFSL; and Independent reimbursement, from the customer just, through a fixed buck cost. (https://sandbox.zenodo.org/records/118430)

There are numerous advantages of an economic organizer, no matter of your circumstance. The goal of this blog site is to verify why everyone can benefit from a financial strategy. financial advisor redcliffe.